Site Selection Factors Series: #7 Corporate Tax Rate

April 10, 2017

PCED Staff Note: This week’s post is part of a series on evaluating site selection factors from a local perspective titled, “Site Selection Factors”. The aim of the series is to outline the criteria used by companies to determine where they will build new facilities or expand existing ones. We will examine the top 10 factors as adapted from Area Development Magazine’s, “The Top Factor’s to Navigate the Location Maze”¹. Those factors, listed in order of priority, are as follows: Availability of Skilled Labor, Highway Accessibility, Quality of Life, Occupancy or Construction Costs, Available Buildings, Labor Costs, Corporate Tax Rate, Proximity to Major Markets, State and Local Incentives, Energy Availability and Costs. Guest bloggers will contribute each week from their area of expertise. Some topics may span multiple weeks.

As I write this blog a few days before the April 15, 2017 tax deadline, most citizens know this day in April as the general deadline to file personal federal and state tax returns. If you owe the government personal taxes, you are probably getting ready to write the check or make your payment online. If you have overpaid your personal taxes this past year, you probably have already filed your tax returns and are looking for or have already received your refund! Businesses/Corporations also need to file tax returns at the appropriate time of year and this blog will provide some clarity on Corporate Income Taxes.

The seventh factor on the top 10 list of site location factors identified by site consultants in the Area Development 2016 survey is the Corporate Tax Rate. Why is there so much ado about Corporate Income Taxes, when there are other taxes that site selection consultants analyze when searching for business locations?

The American Legislative Exchange Council evaluated 10-year economic-performance data for the 50 states and correlated that with the eight states with the lowest corporate income-tax rates and the eight states with the highest. “The conclusion: States with low or no corporate income taxes are outperforming their high-tax counterparts.”1

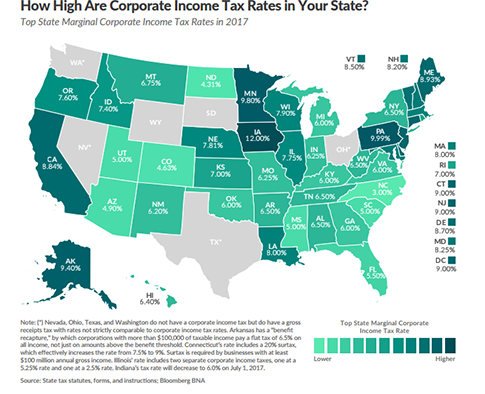

Let’s start with the good news, NORTH CAROLINA’s current flat rate of 3% is the lowest Corporate Tax Rate in the United States, according to the Tax foundation and State Corporate Income Tax rates and Brackets compiled on February 27, 2017. 2 There are forty-four states that levy a corporate income tax and the ranges of the tax rate goes from the low of 3% in North Carolina to a high of 12% in Iowa. 3 “South Dakota and Wyoming are the only states that do not levy a corporate income or gross receipts tax.” “Four states don’t levy a corporate income tax but impose a gross receipts taxes.” .4 “Gross receipt taxes are generally thought to be more economically harmful due to tax pyramiding and non-transparency.”5 “ A couple of states such as Delaware and Virginia impose gross receipts taxes in addition to corporate income taxes.”6

In a ranking of the 50 states, North Carolina is listed 4th best in the category of Corporate Tax Rate according to the 2017 Corporate Tax Rank of the Tax Foundation, (Table 1) State Business Tax Rates and Brackets for 2017 as identified below:

| North Carolina | 4th | |

| Utah | 3rd | |

| South Dakota & Wyoming | 1st (Tie) |

The North Carolina General Assembly got it right in 2013 when they approved comprehensive state tax reform designed to make North Carolina an even more “business friendly state with more business friendly corporate taxes.” The North Carolina General Assembly lowered the Corporate Income Tax to a FLAT 3% rate. “Graduated Corporate (Income Tax) Rates are inequitable – that is, the size of a corporation bears no necessary relation to the income levels of the owners. Indeed, low-income corporations may be owned by individuals with high incomes, and high-income corporations may be owed by individuals with low incomes.”7

In summary, call us in Person County, North Carolina. We are a business friendly state and of course, “Everything is Better in Person!”

Footnotes:

- https://taxfoundation.org/state-tax/corporate-income-taxes/

- Morgan Scarboro, “State Corporate Income Tax Rates and Brackets for 2017.” The Tax Foundation, February 2017. https://files.taxfoundation.org/20170224134124/Tax-Foundation-FF542.pdf

- Ibid.

- Ibid. The 4 states that impose gross receipt taxes are Nevada, Ohio Texas and Washington.

- Ibid.

- Ibid.

- Jeffrey L. Kwall, “The Repeal of Graduated Corporate Tax Rates.” Tax Notes (June 27, 2011): 1395, June 27, 2011.

¹ “The Top Factors to Navigate the Location Maze.” Area Development, Volume 51, Number 4, Q42016, pp. 24-36.

Stuart C. Gilbert is the Economic Development Director for Roxboro and Person County, NC. He has over 30 years of experience in the area of economic development from across the region and the US. Give him a call at 336.597.1752.

ADD ITEM TO REPORT

As you navigate our website, you can use the “Add Item to Report” button to add any page or property to a custom report that you can print out or save.